Many voters who voted for Trump in 2024 did not do it because of his charming and endearing personality. They did it because they expected he would institute good, strong policies, especially in the area of economics.

While those economic policies fell somewhat short of expectations during the first quarter of 2025, they have shown signs of improvement during the second quarter. Not everything is great, there are still some areas of concern, but the overall trend seems to be positive.

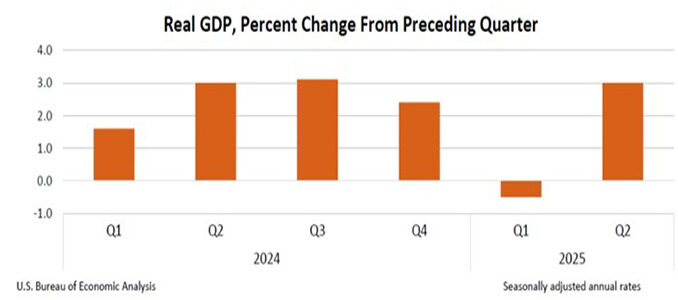

GROSS DOMESTIC PRODUCT:

The star of the second quarter economic show was the gross domestic product (GDP), with its 3.0% growth.

This 3.0% increase is very significant because most economists had been predicting rates of anywhere from 1.4% to 2.8% The new rate is a pleasant surprise. This is how the U. S. Bureau of Economic Analysis (BEA) explained it:

“The increase in real GDP in the second quarter primarily reflected a decrease in imports, which are a subtraction in the calculation of GDP, and an increase in consumer spending. These movements were partly offset by decreases in investment and exports.”

The decrease in imports is most likely a result of the new tariffs. If so, it is an indication that the tariffs are doing their intended job.

According to the BEA, Consumer Spending, also referred to as Personal Consumption Expenditures, went up 0.3%, thus creating a positive influence on the GDP. Two other related numbers, Personal Income and Disposable Personal Income also increased by 0.3%. Both are good news for consumers.

One word of caution is in order regarding the latest GDP numbers. Typically, the GDP is reported in one initial, advance estimate, followed by two monthly revisions. For example, the first quarter advance GDP estimate was a contraction of -0.3%. After the subsequent revisions were applied, it had been lowered to -0.5%.

It is possible that the final GDP number for the second quarter will end up being higher or lower than the initial estimate of 3.0%. However, when these revisions are applied, the result is generally not far from the initial estimate.

INFLATION:

Inflation is always a concern for most families. During the second quarter it was as follows.

| MONTH | RATE |

| April | 2.3 % |

| May | 2.4 % |

| June | 2.7 % |

Even though inflation has not come close to the disastrous rates experienced during the Biden administration, it is still a concern because it has been creeping up during the second quarter and there is no indication that it will decrease. In fact, there is a lot of fear that it will continue to increase because of higher prices generated by the new tariffs. One reason why the Federal Reserve is reluctant to decrease interest rates is that doing so may cause higher inflation rates.

INTEREST RATES (FEDERAL DISCOUNT RATE) – Currently 4.25% to 4.50%:

It is no secret that President Trump has been pressuring Federal Reserve (Fed) Chairman Jerome Powell to lower interest rates. However, at the July meeting of the FED, a decision was made to leave interest rates intact.

It should be noted that the Fed’s Chairman, Jerome Powell, does not have the authority to change interest rates singlehandedly. That decision is made by the Federal Open Market Committee (FOMC). The FOMC consists of 12 members. They include the 7 Federal Reserve Board of Governors members (including Powell), plus 5 other members.

If Powell were to resign or be fired, the decisions of the FOMC would not necessarily be affected.

At the July meeting of the FOMC, Powell explained the decision to leave interest rates as follows:

“We believe that the current stance of monetary policy leaves us well positioned to respond, in a timely way to potential economic developments. My colleagues and I remain squarely focused on achieving our dual-mandate goals of maximum employment and stable prices for the benefit of the American people”

Another way of putting the dual-mandate of the Fed is to encourage growth and keep inflation low. Based on the current GDP number, there is not much need to reduce rates to stimulate growth. The creeping inflation that was at 2.7% in June was way below what we experienced during the Biden administration. However, it is substantially above the Fed’s target of 2.0% and is likely to increase as tariff-induced price increases make their way through the economy.

Under these conditions, it seems prudent to keep the current interest rate until there is sufficient data to warrant a move one way or the other. However, we are already seeing some changes.

- We will not know the inflation rate for July until mid-August, but experts are predicting an increase.

- The jobs created in July were 73,000, short of the 100,000 predicted.

- Unemployment rose in July to 4.2% from 4.1% in June.

All of this will influence what the Fed does with interest rates next time it meets, in September.

STOCK MARKET:

Most people do not engage in stock trading and consequently have no interest in what stocks are doing. However, a significant portion of the American people are in the market indirectly via their retirement plans and/or other financial instruments.

Stocks had a very poor second quarter start, as they registered significant losses in early April. Thankfully, by the end of June they had recovered their losses and even registered a year-to-date modest growth. Here is how they have performed, as of July 31:

| MAJOR INDICES | YTD GROWTH (%) |

| DOW JONES | 4.10 |

| NASDAQ | 9.55 |

| S&P500 | 8.02 |

Even though our economy is in pretty good shape overall, there is still a lot of uncertainty, especially as the effects of the new tariffs manifest themselves. Therefore, stocks are likely to be plagued by high volatility in the foreseeable future.

vs – give the county away to foreign national criminals.. including our tax dollars – paying the world huge ‘amounts of dollars to buy ‘China’ and produce ‘nothing.. being forced to buy ‘this refrigerator, that car, this ‘shower head’ the list is unending – and be ruled by the AUTO PEN.. IT’S! WAY WAY WAY WAY WAY BETTER NOW!!! I’d take my chances with this over the other ANY DAY OF THE WEEK !