Dear Independent Thinker:

Time sure flies when a nation with a fraying social fabric and a ballooning debt doesn’t address its life-threatening problems.

It’s hard to believe that 28 years have flown by since I was active in healthcare reform. The nation’s dysfunctional healthcare system has worsened in the intervening years.

On August 18, 1997, the Wall Street Journal published a long commentary of mine on why there was a market failure in medical insurance and medical care in the United States—a failure that had resulted in a clunky, costly Byzantine system in which unaccountable and faceless parties have come between the consumers of healthcare and the providers of healthcare.

The third parties include employers, insurance companies, politicians, government bureaucrats, the IRS, pharmacy benefit managers, consultants, and the AMA and other rent-seekers.

Since then, ObamaCare and Robert F. Kennedy Jr have joined the third parties that come between doctors and patients.

It’s a different world from when I was a kid long ago, when Dr. King would come to our humble house to see why I was running a fever. My working-class parents would pay him in cash or write a check. It was as simple as that. No HIPAA forms, no insurance forms, no deductibles, no copays, no busybody bureaucrat looking over Dr. King’s shoulder.

Soon after the publication of my WSJ commentary, I hosted a national conference on healthcare reform in Phoenix, at my expense, attended by nationally renown experts on the subject, by politicians, and by employers, including Walmart.

In my opening remarks, I said that my motivation was not to leave my six-year-old son and his generation with the mess and with its unsustainable costs.

Well, they’ve inherited the mess, along with a national debt and a level of government dependency that are an existential threat to the republic.

ObamaCare has become a lighting rod in the current budget battle between Democrats and Republicans. Its costs have ballooned as it has morphed into an entitlement for the middle class and the upper-middle class. Ironically, the original idea behind ObamaCare was to make medical insurance affordable by putting an end to free-riding, moral hazards, and adverse selection.

It did no such thing. Of the nearly 25 million Americans enrolled in ObamaCare, 90 percent or so receive a government subsidy in the form of a tax credit and/or a lower premium, including people who make more than 400 percent of the federal poverty level. Not surprisingly, 75 percent of Americans are against Congress letting the subsidies expire.

Thankfully, there is no need for me to go into the disgusting fiscal and political details of ObamaCare. That has been done by David Stockman, the former budget director under Ronald Reagan. His somewhat polemical but fact-laden treatise is pasted below.

There are two problems with the treatise: First, in this age of tweets, memes and soundbites, few Americans have the patience anymore to read anything longer than 300 words. Patience and attention spans have dropped while the complexity of issues has grown exponentially. Second, once an entitlement is granted, facts and costs are no longer relevant and won’t change anything.

My apologies to my son and his generation for failing to reform the system.

Cheers,

Craig Cantoni

Tucson

Rep. Marjorie Taylor Greene Needs Remedial Math On The Fiscal Monster Known As ObamaCare

By David Stockman | Oct. 9, 2025

Well, that didn’t take long. As we have expected, the King of Debt is fixing to throw in the towel on the Dem demands for $350 billion in higher ObamaCare spending over the next decade in return for re-opening the government, and he’s getting a surprising “ata boy” from MAGA stalwart Rep. Marjorie Taylor Greene.

“I’d like to see a deal made for great health care,” Trump told reporters in the Oval Office on Monday, responding to questions about Affordable Care Act subsidies set to expire at the end of the year.

Rep. Greene was even more explicit in her post on X:

But I’m going to go against everyone on this issue because when the tax credits expire this year my own adult children’s insurance premiums for 2026 are going to DOUBLE, along with all the wonderful families and hard-working people in my district.

For crying out loud. ObamaCare was a fiscal monster from the get-go, and it was made far worse by the pandemic era “enhanced” tax credits which were smuggled into law via “Joe Biden’s” American Rescue Plan Act (ARPA) of March 2021. Yet rather than leveling with the American public about the massive, inequitable and unsustainable cost of ObamaCare— with or without the so-called “enhanced” subsidies—the fiscal chicken-hawks in the GOP are whining loudly about a largely phony issue: Namely, that the Dem alternative to their so-called “clean’ CR will give free health care to illegal immigrants.

That’s mostly a red herring, but the problem is that there are so many different categories of legal and illegal immigrants that the Dems will likely dicker with the White House deep into the statutory weeds, claiming that the ObamaCare problem is “fixed” because they closed some or even most of the actual loopholes now contained in their proffered language. Yet these loopholes for true illegal aliens amount to small change at best (i.e. emergency care under Medicaid), and their removal wouldn’t amount to a tinker’s damn compared to extension of the $350 billion cost of the “enhanced” tax credits for upwards of 21 million regular Americans.

That is, the Trumpified GOP will declare a “fair deal” has been reached and re-open the government even as they ignore the massive fiscal elephant in the room. To wit, the ObamaCare tax credits involve an insane amount of free stuff to middle class taxpayers mainly because the underlying reality is that the third-party paid medical insurance system—both private and government run—has inflated the bejesus out of the US health care system.

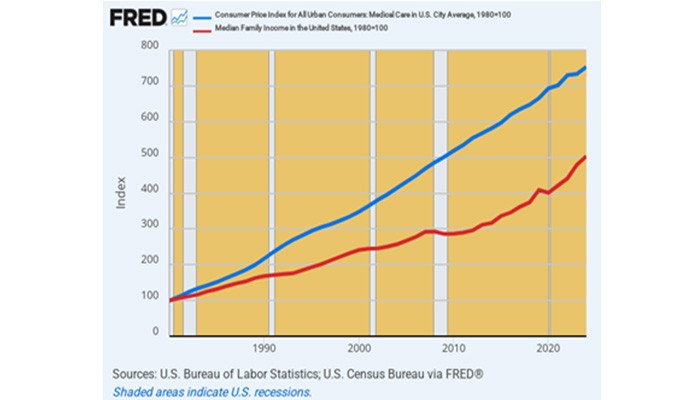

For want of doubt and relevant background, here is an index of median family income (red line) since 1980, which is up by 400%. Unfortunately, during the same period the CPI medical care index (blue line) is up by 650% or 1.6X more. In other words, the blue line in the graph below has been rising at nearly a 5.0% per annum rate for the past 44 years running—so there is no way that sustainable family incomes can catch-up under the status quo.

Index Of Median Family Income Versus CPI Medical Care, 1980 to 2024

The fundamental evil of ObamaCare enacted in 2010, of course, was that it injected massive new health care buying power into the system complements of the US taxpayers, but did absolutely nothing about the fundamental inflationary drivers already built into the nation’s medical payments system. That is, the third party payment mechanism which basically eliminates both consumer and provider incentives to control the cost and quantity of medical care delivered.

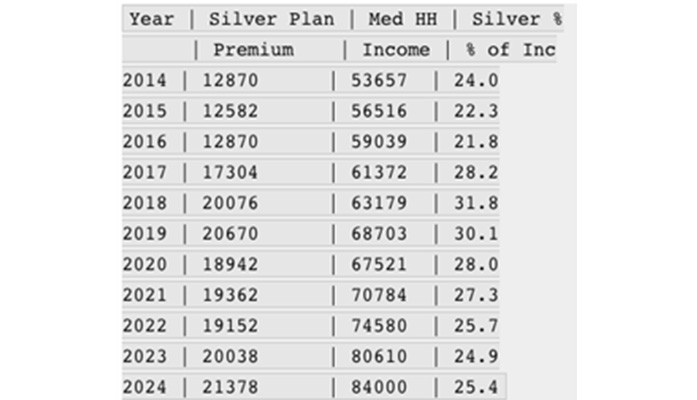

In fact, during the early years of the ObamaCare, health costs skyrocketed. The table below shows the premium cost for a so-called basic or “Silver Plan” under ObamaCare. The latter rose from $12,870 for a family plan in 2014 to $20,670 per year in 2019. That computes to 10.0% per annum increase at a time when median family income increased by only 5.0% per annum.

As a result, the full premium (before tax credit subsidies) for the Silver Plan rose from 24% of median family income in 2014 to 30.1% in 2019. Thereafter, premium cost growth slowed sharply, in part due to the perturbations in the health care system generated by the pandemic and related regulatory interventions. But much of the gain in nominal family income during the period was owing to the 40-year high inflation of 2021-2024, not real gains available to pay for sky-high insurance premiums.

Cost Of ObamaCare Silver Plan Premiums, Median Household Income and Premium % Cost, 2014-2024

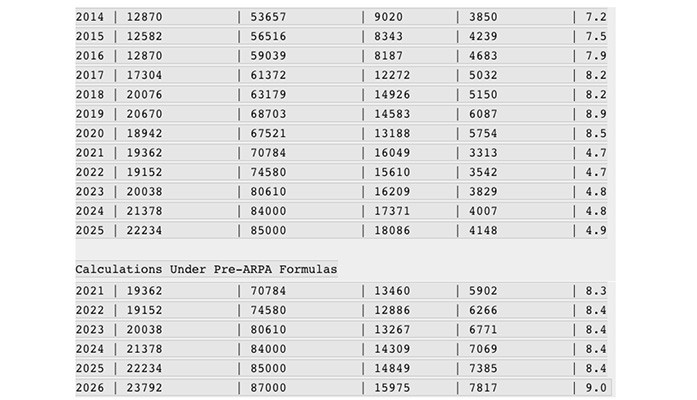

Needless to say, the whole idea of ObamaCare was to shift the cost of these huge and rapidly rising premiums from middle class American households to their purportedly rich Uncle Sam. But that was a fiscal sink-hole from the beginning, as shown in the table below for the median income household. By 2014 when ObamaCare (ACA) had been fully phased-in, the tax credit for the median household with $53,657 of annual income was $9,020 or roughly 70% of the premium cost.

In turn, that reduced the out-of-pocket cost of the premium to $3,850 or about $321 per month, thereby lowering the premium from 24% of the median household income to just 7.2%, as shown in the final column.

Of course, here’s the thing: If the median income household was getting $9,020 of free stuff at the get go, who in the hell was going to pay the tab as premiums raced skyward? The so-called rich were already paying upwards of 75% of Federal income taxes. So what ObamaCare was really predicted upon was deficit-finance and the piling of crushing debt on future generations.

Moreover, as medical care costs continued to soar at the aforementioned 10% per annum rate through 2019, the cost of the ACA tax credit, as shown in the third column, rose by +62% to nearly $14,600 per household under the Silver Plan. Again, that kept out-of-pocket costs to $6,087 per year by 2019 and just 8.2% of median household income.

Stated differently, household income grew by 28% or $15,046 per year during 2014 to 2019, but the out-of-pocket expense to the median household rose by just $1,581 or10%. So what was happening is that Washington was chasing its own fiscal tail. The massive additional demand funded through Medicaid and the ACA Exchanges under ObamaCare was driving up costs rapidly, but even the median income family barely felt it because tax credit subsidies were rising even faster.

Alas, that was hardly the end of it. Look at the comparison of 2019 with 2021 when the Biden “enhanced” subsidies under the American Rescue Plan Act (ARPA) kicked in. It doesn’t take much arithmetic to see that Uncle Sam got the short end of the stick. To wit, the two-year change between 2019 and 2021 was as follows:

- Silver Plan Premiums: -$1,038.

- Median Household Income: +$2,081.

- ACA credit: +$1,466.

- Out-of-Pocket:-$2,774.

Holy moly. Talk about a scam! The so-called pandemic became an excuse to cut relatively low out-of-pocket costs by $2,774 per year to median income households, and reduce out-of-pocket expense for ACA insurance from 8.9% of income in 2019 to just 4.8% during the last four years.

Still, another ill that resulted from the Donald’s foolish declaration of the Covid “state of emergency” in March 2020 was an unhinged political climate in Washington, which literally blew the Federal debt sky high. Not only did the three Covid relief bill, including the Biden ARPA, generate $6 trillion of added spending, but the later included an utterly unwarranted increase in the ACA tax credit that now threatens to become permanent. That is, another case of what President Reagan called the eternal life of “temporary” and “emergency” Federal programs.

For want of doubt, we show in the bottom panel of the table, what the ACA tax credits and out of pocket costs would have been during 2021 to 2025 had the ARPA not been enacted. To wit, the out-of pocket cost under the original ObamaCare formulas would have remained at about 8.6% of median household income through 2025!

In a word, the ACA premiums during 2021-2026 relative to income would have been exactly what the Dems authored in 2010 and what they preserved when Trump 1.0 tried to repeal the program in 2017, only to be saved by the war-mongering Senator John McCain.

So the question recurs, if a median income household with $68,703 of income could afford to pay $6,087 8.9% in out-of-pocket cost for their Obama Exchange medical insurance in 2019 why couldn’t they afford to pay $7,308 or 8.6% of income in 2025?

After all, the median income went up by nearly +24% to $85,000 during that six-year period, while the out-of-pocket premium under the original ObamaCare formula would have risen from $6,087 per year to just $7308 or by +20%. That is, the median household would have had $16,297 more income to pay just $1,221 more in out-of-pocket costs for their health insurance. Is that really all that onerous?

In truth, all the anguished complaints about out-of-pocket insurance premiums doubling ain’t that at all. Under the original ObamaCare formula, which will now snap-back into place—as promised back in 2022 when it was extended thru the current year—out-of pocket premiums would have risen by 3.1% per year over 2021 to 2026, while median income would have risen by 3.6% per year.

If the middle class can’t live with that, America will be bankrupt even sooner than suggested by the disastrous path we are already on.

ObamaCare Premiums, Median HH Income, ACA Tax Credits, Out-of-Pocket Costs and % of Income, 2014 to 2024, With And Without Enhanced Subsidies

Year Silver Premium Median HH Inc. ACA Credit Out-of-Pocket %

And this gets us to the remedial math course implicated for MAGA stalwart, Rep. Marjorie Taylor Greene, who has broken ranks with the GOP position on extending the ObamaCare free stuff under the enhanced tax credits of the ARPA. She says that her two adult daughters Taylor (26) and Lauren (28) will face a doubling of premiums on the Obama Exchanges if Joe Biden’s fiscal folly is not extended.

To be sure, both daughters were likely eligible under the ObamaCare strictures for child coverage thru age 26 under Rep Greene’s Federal Employee Health Benefit Plan (FEHBP) since she came to Congress in 2021. Indeed, the actuarial cost of the health plan for Rep. Greene, her spouse and two daughters would have been about $13,000 per year, but due to cushy Congressional compensation arrangements, her out-of-pocket share would have been a scant $2,700 for the entire family. So compared to the much high premiums on the ObamaCare exchanges, we get why Rep. Greene and her no longer grandfathered daughters are bitching.

But set aside Congressional privileged for a moment and look at the data assuming that both daughters had been earning the median household income since 2021 and had been purchasing the Silver family plan. Under the original ObamaCare formulas, their incomes would have been equal to 272% of the Federal Poverty Line (FPL), which would have put them in the 250% to 300% of FPL bracket. Under the original law the cap on out-of pocket costs for ACA premiums was 8.05% of income at 250% and 9.5% of income at 300%, yielding a blended average of 8.688%.

In turn, that would have amounted to a dollar cap of $7,385 or 8.4% of income on out-of-pocket payments toward a premium of $22,234 for 2025. The ACA tax credit, therefore, would have covered the difference or $14,926.

By contrast, here is how the much bigger dollop of free stuff under the “Joe Biden” ARPA would be calculated. At the same break points of 250% and 300% of FPL, the caps would be 4.0% and 6.0%, respectively, yielding a blended average of 4.88% or barely half of the pre-ARPA caps. In dollar terms, the resulting out-of-pocket limit for the median household income would be $4,148 per year after a much higher ACA tax credit of $18,o86. In short, for the median income household Sleepy Joe’s generosity is worth more than $3,160 annually at present. That even beats the $2,000 per person stimmy checks handed out during the pandemic!

Moreover, if you look at the five years covered by the ARPA (2021 to 2025), the cumulative cost of premiums under original ObamaCare would have been $83,304 for a family Silver Plan, which compares to only $68,848 under the ARPA. That is to say, the ballyhooed “enhanced subsidies” have amounted to $14,456 per family during the last five years.

In the hypothetical case where Rep. Greene’s daughters had been purchasing the family Silver Plan and had earned the median household income during the last five years, the Greene family would have netted a windfall of nearly $29,000. No wonder they are squawking about loosing the free stuff!

In any event, the ARPA was a drastic, costly mistake. Had the original ObamaCare formulas stayed in place, the Silver Plan’s out of pocket cost would have been $7,385 this year, or 8.4% of income, and would have risen by 7% to $7,817 in 2026 or 9.0% of income. Yes, a relatively stiff increase, but not the end of the world by any means.

Funny thing, moreover. This 9.0% of income out-of-pocket premium contribution projected by Grok 4 for 2026 is what median income households were paying in 2019, yet no one from the Dem side was shutting down the government in order to force payments down by more than $3,000 per year.

Nor was the Trumpified GOP of 2019 fixing to capitulate on ObamaCare subsidies, as MAGA stalwart Greene and her dear leader in the White House have already done.