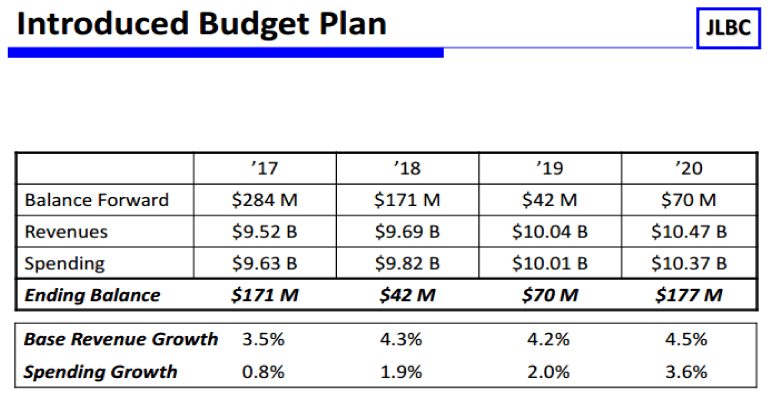

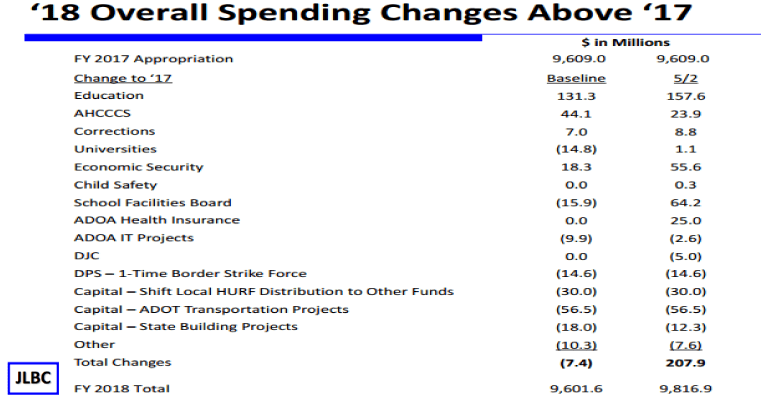

The Arizona Legislature and the Governor appear to have reached an agreement on the budget. On Tuesday, the Joint Legislative Budget Committee released the plan, which includes a small raise for teachers.

Today, the Appropriations Committees will consider the budget package. By the time the public is able to comb through the budget package and identify the sweetheart deals, it will likely already be approved.

ENVIRONMENT – HB 2541/SB 1526 Counties and Cities & Towns Section

25. * As permanent law, allow Pima County to purchase land within the boundaries of a city or town if the acquisition of the land is part of an intergovernmental agreement for the governing body of the city or town.

HIGHER EDUCATION – HB 2543/SB 1528

Community Colleges

59. As session law, continue to suspend Science, Technology, Engineering and Mathematics and Workforce Programs funding formula and

operating state aid for FY 2018 and specify the funding in the General Appropriation Act.

60. * As permanent law, restore Maricopa and Pima Community College formula funding for both operating and STEM. Due to the other

Community College BRB provision, this will not result in additional funding in FY 2018.

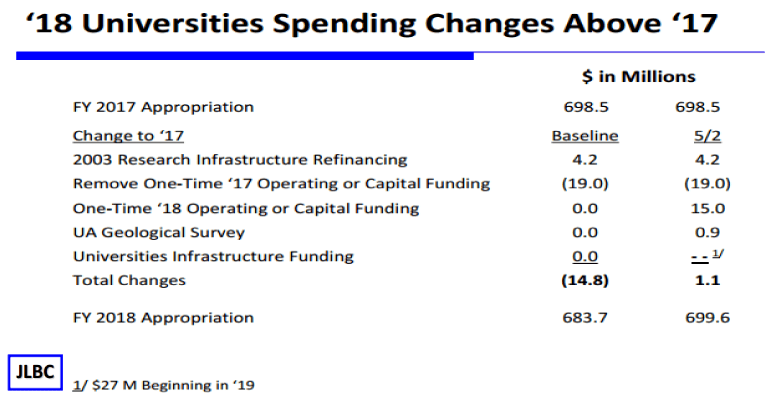

Universities

61. As session law, continue to suspend the statutory requirement that the state provide a 2:1 ratio of state funding to student fees deposited into Arizona Financial Aid Trust (AFAT).

62. As session law, require the universities to implement an Arizona Teacher Academy, which shall provide full tuition and fee waivers to enrolled students who agree to teach in an Arizona public school for at least the number of years they were enrolled in the Arizona Teacher Academy.

Those who do not fulfill their teaching requirement are required to pay back the proportion of tuition and fee waivers that corresponds to the number of years of teaching requirements they did not fulfill.

63. As permanent law, require ABOR to complete a comprehensive study of the cost of educating a resident undergraduate student every five years beginning in FY 2018 and annually issue a report on cost containment measures, tuition rate increases and the allocation of faculty resources between instruction and research.

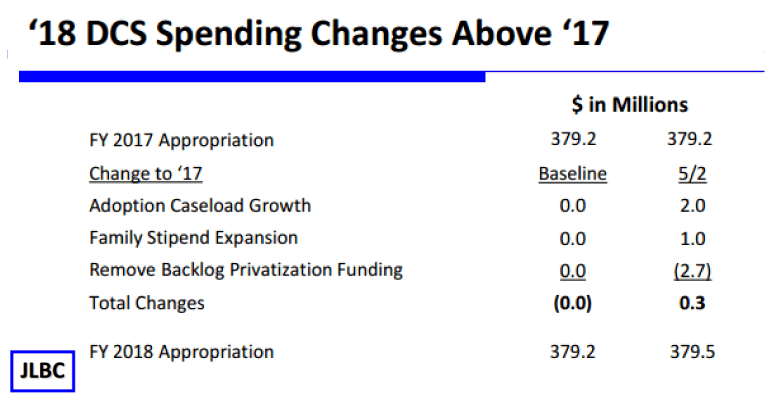

HUMAN SERVICES – HB 2544/SB 1529 Department of Child Safety Section

64. As session law, continue to require the department to report with the Early Childhood Development and Health Board on collaborative efforts on child welfare issues.

65. As session law, require the Auditor General to complete audits of caseworker workload and foster home recruitment and retention.

Department of Economic Security

As session law, continue to require recipients of Temporary Assistance for Needy Families (TANF) Cash Benefits to pass a drug test in order to be eligible for benefits if DES has reasonable cause to believe that the recipient uses illegal drugs.

Department of Education Section

JTEDs

As session law, continue to fund state aid for Joint Technical Education Districts (JTEDs) with more than 2,000 Average Daily Membership

(ADM) students at 95.5% of the formula requirement and reduce budget limits accordingly.

Formula Requirements

As permanent law, increase the base level (A.R.S. § 15-901B2), the transportation funding levels (A.R.S. § 15-945A5) and the charter school “Additional Assistance” amounts (A.R.S. § 15-185B4) by 1.31% for standard inflation.

Funding Formula Changes

As session law, continue to reduce school districts’ Additional Assistance state aid by $352,442,700 and reduce budget limits accordingly. As session law, continue to reduce District Additional Assistance funding to school districts that do not receive state aid in FY 2018 by the amount that would be reduced if they did qualify for state aid for FY 2018 and reduce budget limits accordingly.

As session law, continue to reduce Charter Additional Assistance by $18,656,000.

As session law, continue to cap total District Additional Assistance reductions for school districts with fewer than 1,100 students at $5,000,000.

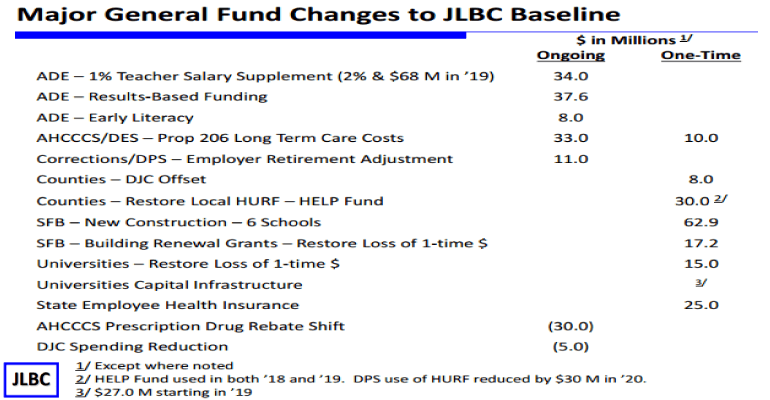

* As permanent law, establishes a results-based funding program to provide extra per-pupil funding to a district school or charter school with AzMerit scores in the top 10% of the state. Schools with 60% or more of students eligible for free or reduced-price lunch (FRPL) would also qualify if the school’s AzMerit scores are in the top 10% compared to other schools with 60% or more FRPL-eligibility. Schools with less than 60% must be in top 10% of all schools. If a school meets the FRPL eligibility criteria, the school will receive $400 per student. Other qualifying schools will receive $225 per student. Integrates A-F rating system beginning in FY 2019. Schools will be required to be A-Rated to receive results-based funding in FY 2019.

REVENUE – HB 2546/SB 1531

Counties and Cities & Towns

As session law, continue to allow counties with a population below 250,000 in the 2010 decennial census to use any source of county revenue to meet a county fiscal obligation for FY 2018, up to $1,250,000 of county revenue for each county. Requires counties using this authority to report to the Director of JLBC on the intended amount and sources of funds by October 1, 2017.

Department of Public Safety

90. * As session law, deposit $30,000,000 of HELP Fund monies to local HURF for distributions in FY 2018 and FY 2019.

91. * As session law, continue the previously approved $30,000,000 shift of Highway Patrol costs from HURF to the General Fund in FY 2019 and increase the shifted amount to $60,000,000 in FY 2020.

Universities

95. As permanent law, appropriate $27,000,000 to the universities each year beginning in FY 2019 through FY 2043, increased annually by the lesser of 2% or inflation, for capital project debt service or cash construction costs (FY 2019 allocations: ASU: $11,927,400, NAU: $4,520,900, UA: $10,551,700).

96. As permanent law, establish a Capital Infrastructure Fund (CIF) for each university, into which the annual appropriation shall be deposited in addition to a 1:1 match from the university.

100. As permanent law, modify A.R.S. § 15-1670 to adjust the university technology transfer royalty and intellectual property income sharing requirements for all agreements entered into beginning May 1, 2017 to use net income in the first 3 years of royalties for a given project and gross revenues each year thereafter and gross revenues from intellectual property sales. Clarify that calculations for projects are based on prior year, not cumulative, amounts, and that deposits to the General fund shall not exceed the appropriations made to the CIF plus appropriations for research infrastructure pursuant to A.R.S. § 15-1670.

GENERAL APPROPRIATION ACT PROVISIONS – HB 2537/SB 1522

Counties and Cities & Towns

105. As session law, in accordance with statute (A.R.S. § 9-601), continue to appropriate $22,499,000 from the General Fund for the Phoenix Convention Center.

106. As session law, continue to provide sales tax revenues to the Rio Nuevo Multipurpose Facility District in accordance with statute (A.R.S. § 42-5031).

Statewide

114. As session law, continue to require ADOA to compile a report on Full-Time Equivalent (FTE) Position usage in FY 2018 in all agencies and provide it to the JLBC Director by October 1, 2018. The Universities are exempt from the report but are required to report separately.

115. As session law, continue to require each agency to submit a report to the JLBC Director by October 1, 2017 on the number of filled appropriated and non-appropriated FTE Positions by fund source as of September 1, 2017.

116. As session law, continue to require ADOA to report monthly to the JLBC Director on agency transfers of spending authority from one

expenditure class to another or between programs.