The Ninth Circuit gave Arizona a huge victory in its fight against the Biden Administration’s Tax Mandate under the American Rescue Plan Act. Arizona filed a lawsuit against the U.S. Department of Treasury and federal officials in March 2021, challenging the Tax Mandate and alleging that the mandate threatens to penalize states by withholding federal COVID-19 relief funding if they lower taxes in any fashion.

In January 2022, the Arizona Attorney General argued that the mandate is unconstitutional and threatens state sovereignty. He asked the court to declare the mandate unlawful and enjoin enforcement of it.

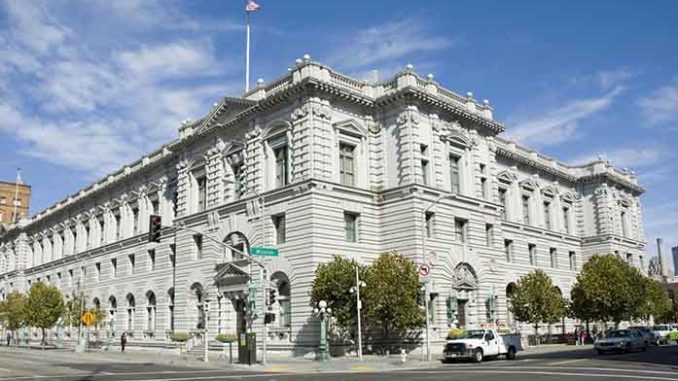

In a 3-0 decision, the Ninth Circuit agreed Arizona has standing to challenge the Tax Mandate because it inflicts sovereign injury on the state and that there is a realistic threat of enforcement.

The Act stipulates that the $4.7 billion for Arizona’s COVID-19 recovery, may be used to respond to the public health emergency, negative economic impacts, (including assistance to households, small businesses, and nonprofits), or to aid impacted industries such as tourism, travel, and hospitality. However, the Tax Mandate section of the Act forbids states from using the COVID-19 relief funds to “directly or indirectly offset a reduction in… net tax revenues.” That stands in stark contrast to the Act itself in which Congress provided extensive tax relief as economic stimulus—but simultaneously attempted to ban the states from providing any stimulus through tax relief themselves.

Unless the Biden administration seeks further review, the case will go back to the Arizona District Court to determine whether the Tax Mandate is unconstitutional.