In a memo dated January 5, Pima County Administrator Chuck Huckelberry advised Supervisor Ally Miller that County residents, who had petitioned for road repairs, were out of luck. Chuck admitted that he had only allocated $4.5 million of the over $50 million the County receives for roadways.

Miller had urged Huckelberry to address the “serious safety concerns” of Anna Maldonado and the over 270 residents who signed her petition asking for action.

Many were surprised that Huckelberry was so candid about the fact that so little was set aside given the failing conditions of the County’s roads. The fact that he admitted that little over 15 miles of failing roads would be repaired this year was astonishing given his history of exaggerating his performance.

It is a new year, and residents hoped that with a renewed contract in hand, Huckelberry would feel confident enough to be candid enough to earn his exorbitant salary and the public’ trust.

Unfortunately that is not the case.

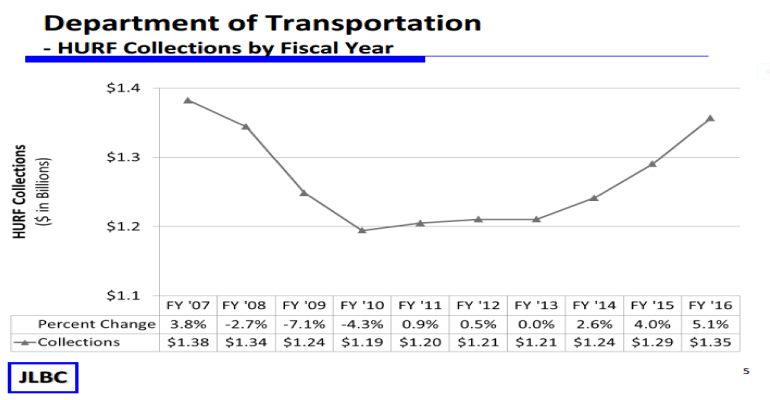

In an interview on the James T. Harris show, Miller explained that Huckelberry continues to promote the myth that the Legislature has swept the HURF funds away from County coffers, and as a result, raising taxes is the only hope for desperate drivers.

“HURF fund consists of monies collected from motor fuel tax and motor vehicle fees, including Vehicle Licensing Tax (VLT) and registration fees. HURF monies are used for highway construction, maintenance, improvements and other expenditures in the state and distributed to fund other related expenses and local levels. Initial distributions are made from HURF to the Economic Strength Project Fund and to the Department of Public Safety for the highway patrol function. Remaining HURF monies are distributed as follows: 31.8% to cities, 19.8% to counties, 7.4% controlled access and 41% to the State Highway Fund. State Highway Fund monies are further allocated to counties based on population.” – Surface Transportation Funding Task Force

In other words, HURF funds are gas tax dollars set aside for road repair and maintenance across Arizona. While those funds were shrinking for a number of years, they are experiencing an increase currently. Still, hundreds of millions of dollars in HURF revenue has been received by Pima County since 1994.

Only a fraction of those millions have been swept by the state legislature over the years.

According to an investigation by Supervisor Ally Miller in 2014, over $167 million of HURF had been diverted from road repair and maintenance to cover bond debt since 2004. This left $641 million available for road repair since 1994. The money didn’t go to roads. It went to paying off bond debt.

The Surface Transportation Funding Task Force

Earlier this year, Miller, who has been portrayed as an anti-tax obstructionist, developed a plan to finally repair “our disastrous roads.” It included extending the RTA tax. Just like Anna Maldonado’s petition for repairs, Miller’s plan was rejected by Huckelberry.

Huckelberry wants a regressive tax increase and until he gets his way the roads will not be repaired despite the fact that the money should be available.

According to the Arizona Daily Star, Huckelberry’s tax proposals “have gotten some recent backing from a state task force created by the Legislature to look into ways to improve transportation funding. The dryly named Surface Transportation Funding Task Force released its equally dry final report Dec. 31, and raising the gas tax was one its most repeated recommendations.”

SB 1490 sponsored, by notorious crony capitalist Senator Bob Worsley, created the Surface Transportation Funding Task Force (STFTF). The STFTF met for the first time on September 14, 2016.

The Surface Transportation Funding Task Force statutory duties are:

1. Review the existing, previously prepared reports and analyses regarding transportation needs and revenue sources in this state.

2. Recommend specific revenue proposals for dedicated funding sources for principal interstate highways to meet projected interstate freight capacity needs for 20 years.

3. Recommend specific revenue proposals for dedicated incremental funding sources for the HURF to meet the statewide needs of the state highway system and the roadway needs for other HURF recipients based on the current HURF revenue distribution formulas.

4. Recommend specific revenue proposals for dedicated funding sources for all of DPS’ highway patrol costs, other than the HURF.

5. Recommend specific revenue proposals for dedicated funding options for regional state highway system and highway capacity needs for twenty years.

6. Recommend specific revenue proposals for dedicated funding options for local city, town and county roads and streets.

7. Work with Az. Dept. of Administration to conduct a statewide study to identify vacant or underused buildings that are owned by this state and that could be sold by this state to provide funding for transportation projects.

8. Prioritize the recommendations if the task force recommends more than one proposal for any purpose described above.

According to the Arizona Chapter of the Association of General Contractors’ website:

After introductions, Senator Worsley set the tone by informing committee members the purpose of the committee. He testified that their mission is not to look at specific projects, but to find solutions to funding Arizona’s revenue shortfall. He gave an overview of transportation funding and also gave a presentation on the future of transportation which included how the automobile industry is changing from fossil fuel vehicles to alternatively fueled vehicles. The presentation included an overview on emerging technologies that will completely change the way transportation looks today.

Staff from the Joint Legislative Budget Committee (JLBC) followed his presentation with a complete overview of existing transportation revenues and the distribution thereof.

“Presentations were made by the Maricopa Association of Governments, Pima Association of Governments, County Supervisors Association and Flagstaff Metropolitan Planning Organization. Presentations outlined regional transportation revenue uses and needs, transportation projects and potential transportation revenue source,” at the September 28, 2016 meeting, according to the final Task Force report.

The Task Force made numerous recommendations that would provide for dedicated funding for principal interstate highways, dedicated funding for HURF, and dedicated funding for highway patrol. The various recommendations included an increase and index motor fuel and use fuel tax to produce $10 billion over 20 years; an additional annual registration fee on alternative-fuel vehicles; an increase in license, registration and other fees; an increase in the Vehicle License Tax (VLT) at a rate sufficient to meet the projected annual budget for highway patrol,” according to the report.

As expected due to the make-up of the Task Force, the recommendations favored industry and would hit the working poor the hardest. The following Guiding Principles were adopted without opposition on December 21, 2016 by the Task Force:

Transportation infrastructure funding, or related services funding, should have a reasonable nexus with the group served by the infrastructure or services.

Clearly defined funding sources and uses is preferred, rather than the use of general funding options that could later become diverted to other interests.

All else equal, new tax options should be as simple as deemed reasonable.

Any new considered taxes should be distributed over a wide range of beneficiaries, if possible, and not heavily weighted toward a small group of beneficiaries.

Tax options should be designed to minimize economic distortions, including those related to significantly changing people’s behavior, unless that is a clearly stated goal.

New taxes to pay for transportation-related expenses should be developed in consideration of current taxes that are already being efficiently used for local or regional transportation purposes.

Consideration for proposals should take into account both the ease of administering the tax, fee or program, and the probability for evasion or fraud.

New tax proposals should ensure equitable burden and effort across the entire state.

The state should continue to expand considerations of public-private-partnerships as potential financing mechanisms and the potential for delivering major transportation projects more cost efficiently and effectively.

Tax options should anticipate major changes in economic behavior that may render certain tax structures obsolete. Accordingly, proposed tax options should be relevant to where the economy is heading, not where it has been.

The following Statement of Limitations was adopted without opposition on December 21, 2016:

“The duty of the Task Force was to make recommendations to the Legislature on five defined areas of surface transportation. This substantial and complex assignment, accompanied by a myriad of policy implications, has been accomplished within the requested short timeframe.

The included recommendations are intended to provide broad, general guidance to policymakers.

The recommendations reflect discussions and testimony from Task Force meetings, including a mixture of taxes and fees that could be used to meet each of the five transportation need categories. The Task Force is not recommending any tax or fee increases. That decision rests with policymakers and elected officials.

This report reflects the Task Force’s general recommendations to policymakers of how tax and fees might best be increased, if the decision is made, by policymakers, to raise taxes and fees in order to meet any or all of the categories of need identified in the authorizing legislation.

Given the short timeframe of the Task Force, the recommendations have not been researched, vetted or validated to the level or degree that we, as members of the Task Force, would typically undertake in each of our own professional capacities. Consequently, we urge policymakers to complete a more rigorous analysis of any proposal to raise taxes or fees.”

One thing is for sure, unless lawmakers do something to ensure the counties must use the money for road repairs, Huckelberry will do as he wants when he wants with the cash.