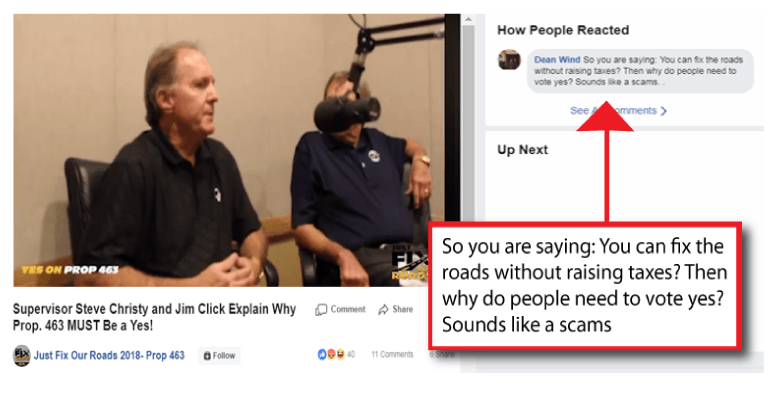

Car salesman, Jim Click, seems to be everywhere these days touting his support for Pima County’s Proposition 463. Rio Nuevo District Board Chair Fletcher McCusker, County Supervisor Steve Christy, and other deep-pockets and notables have joined Click in his crusade.

Proposition 463, a $430,000,000 bond package before the voters, is seen by many as a last ditch effort to avoid fiscal responsibility while fixing a portion of the County’s failing roads. With over 70 percent of the County’s road in “poor” or “failed” condition due to years of fiscal mismanagement, Christy and Pima County Administrator Chuck Huckelberry had sought a regressive sales tax as a solution.

Christy’s scheme, supported by the likes of Click, was killed by supervisors Ally Miller and Richard Elias. Sales taxes hit the poor hardest, and with Pima County the home of the fifth poorest metropolitan area in the country, and increase in the tax would have likely been devastating to residents. Pima County residents already struggle under the weight of the highest property taxes in the state.

Given the sweetheart deals Click enjoys through Rio Nuevo, it is no wonder that business people like him would prefer a regressive sales tax, but will settle for a property tax.

[metaslider id=65385]

Click enjoys the benefits of a Tax Incentive Rebate Agreement with Rio Nuevo and SMG, a company that manages the Tucson Convention Center (TCC) for Rio Nuevo. The agreement involves car shows held at the TCC and reads in part:

NOW, THEREFORE, in consideration of the foregoing recitals, which are incorporated herein by reference, the following mutual covenants and conditions, and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the District and MSG hereby agree as follows:

1. Terms of Agreement. This Agreement shall be effective from March 1, 2018 through February 28, 2020, unless earlier terminated as provided herein (the Term).

2. Financial Incentive Payment(s). When the gross taxable sales revenue for a single Event equals or exceeds $500,000 (Gross Sales Revenue), such Event qualifies the Customer for “Financial Incentive Payment(s) from the District as follows:

a. The Customer shall provide to the District a copy of its agreement with SMG reflecting the Event, the date(s) of the Event, and the amount of Rent and Catering Costs paid by the Customer to SMG together with (i) copies of all transaction privilege tax (TPT)returns filed by the Customer and (ii) evidence of the Customer’s payment of the TPT reflected on each such return (Incentive Application).

b. When the District receives from the Arizona Department of Revenue (ADOR) payment of the amount reflected on the Incentive Application, the District shall remit to the Customer (i) ten (10%) percent of such TPT Incentive Application amount and (ii) up to $6,000 to defray the Customers Catering Costs for such Event. The District shall provide a copy of such was remittance to SMG.

3) Limitations on Incentives.

a. The Financial Incentive Payment shall not exceed the total amount of the Rent paid by the Customer to SMG. In the event that the Financial Incentive Payment amount exceeds the Rent paid by the Customer, such Financial Incentive Payment will be reduced to the amount of the Rent.

b. To qualify for the Financial Incentive Payment, the Event must take place on or after March 1, 2018 and either (i) take place on one calendar day or (ii) take place on five or fewer consecutive calendar days.

4. Confidentiality. The information contained on the Customer’s Incentive Application shall only be used by the District for the purpose of providing the Financial Incentive Payment as set forth herein and for no other purpose. Unless required to do so by law, neither the District nor SMG shall disclose to anyone other that the Customer the information contained in the Incentive Application. [View RN -TCC – Tax Incentive Rebate Agreement Here]

| Rio Nuevo Payments To Jim Click Inc. | |||||||

|---|---|---|---|---|---|---|---|

| 2016 | 26-Sep | $12,300.00 | Jim Click | RN | TCC Rebate | Public Relations | Compass Bank |

| 2016 | 31-Dec | $31,000.00 | Jim Click | RN | TCC Rebate | Public Relations | Compass Bank |

| 2017 | 4-May | $12,000.00 | Jim Click | RN | TCC Rebate | Public Relations | Compass Bank |

| 2017 | 25-Jul | $14,000.00 | Jim Click | RN | TCC Rebate | Public Relations | Compass Bank |

| 2018 | 6-April | $45,000.00 | Jim Click | Rebates | TCC Rebates | Other Fees | Compass Bank |

| 2018 | 24-April | $24,000.00 | Jim Click | Rebates | TCC Rebates | Other Fees | Compass Bank |

| TOTAL | $138,300.00 | ||||||

| Rio Nuevo Payments For Lobbying Services | |||||||

|---|---|---|---|---|---|---|---|

| 2018 | 24-April | $20,750.00 | Paton & Associatesk | RN | Lobbying | Pro Services | Compass Bank |

| TOTAL | $71,500.00 | ||||||

While support for bringing more money into the County through bonds and taxes is understandable to a certain extent, the need for the bonds is unclear. In November 1997, Pima County voters approved $350 million in Highway User Revenue Fund (HURF) bonds, to be repaid with a portion of the County’s share of HURF revenues from the State, to widen and rebuild roadways throughout Pima County and within cities and towns.

A full 18 percent ($62.4 million) of the bonds remain unused as over 70 percent of the roads fell into “poor” or ‘failed” condition.

Related article: Rio Nuevo Extension Expected To Be Rammed Through House Despite Opposition

Last year, Click was busy up at the Legislature with McCusker and lobbyist Jonathan Paton backing Rep. Mark Finchem’s bill which extended the life of the controversial Rio Nuevo District.