PHOENIX — In spite of nearly unanimous support from Republicans in the state legislature, Governor Doug Ducey vetoed SB1143, the Tax Conformity bill that would have ensured that Arizonans did not pay higher state taxes as a result of the Trump tax cuts at the federal level.

The windfall taxpayers received at the federal level created increased tax liabilities at the state level. Lawmakers worked since last year to pass legislation to ensure that Arizona taxpayers would avoid a $150-200 million tax hike, to compensate for lost revenue.

But Ducey wanted the money captured and placed into the state’s rainy day fund and has insisted that it was not a tax increase, merely a windfall that the state should set aside for later.

No matter who ultimately claims the high ground in the debate, the fact is that by vetoing the bill passed by the legislature, the governor has ensured that taxpayers will pay $150 to $200 million in increased taxes this year.

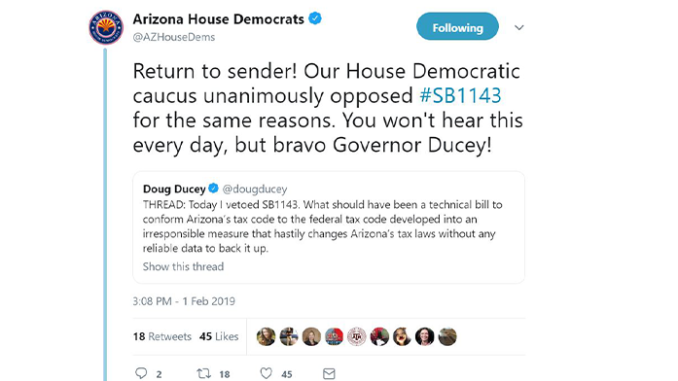

In a long series of tweets to defend the veto, Ducey described the bill as an “irresponsible measure that hastily changes Arizona’s tax laws without any reliable data to back it up.”

There were other inconsistencies in the governor’s statements. Although he said that this bill, to conform Arizona’s tax code changes with the federal tax code, was passed “for no good reason”, he insisted that Arizona would soon conform. This is an odd position for someone who insisted that there was no good reason to pass a conformity bill in the first place.

The Governor also said that while the net result of his actions would not be a tax increase, the state would add to its Rainy Day Fund with the increased tax revenue that will result from vetoing the bill.

Republican Governors in many states have signed similar measures to ensure that their citizens did not face higher state taxes after the Tax Cuts and Jobs Act passed Congress. Every Republican in the Legislature except Senator Kate Brophy McGee voted for the bill. Extra credit goes to Senators JD Mesnard, David Livingston, and Vince Leach, and State Representative Ben Toma, who led the charge in the Senate and House respectively. With Democrats unanimously voting to keep the higher tax revenue in place, there is no opportunity to override the veto.

“I am very disappointed with Governor Ducey’s ill-advised veto,” said Rep. Bob Thorpe. “In opposition to our Tax-&-Spend Democrat friends, House and Senate Conservative Republicans did the right thing in quickly passing the Conformity Bill in order to keep Arizona growing by keeping our citizen’s taxes as low as possible. I completely disagree with Socialist Democrats, who love high taxes so that they can abscond and squander our hard working Arizona family’s money. History proves that under Democrat Presidents Carter and Obama’s high taxes, our repressed economy stalled and stagnated. However, under the tax cuts of Democrat President Kennedy and Republican Presidents Reagan and now Trump, our U.S. free-market economy took off, where our citizens enjoyed job growth, low unemployment and booming prosperity, and where government actually received more revenue, not less.”