Pima County’s net worth dropped from $2.3 billion to an estimated $1.8 billion last week. If it had been reporting its net financial position like private businesses do, the County’s net worth would have always reflected its long-term liability for pensions.

That is not the Pima County way, but things have changed. Now, according to a memo from County Administrator Chuck Huckelberry, the Comprehensive Annual Financial Report will include the County’s long-term pension liability.

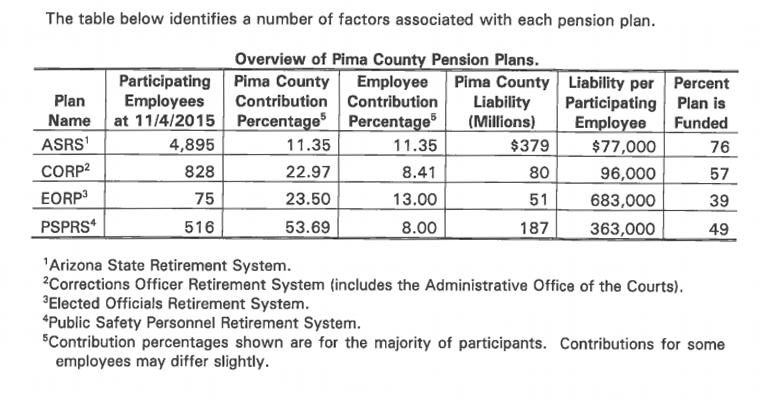

In his memo, Huckelberry writes: “As you can see, the employee liability per plan varies widely. While this total liability does not have to be paid in any given year, the most important action is to address the percentage of the plan that is funded (or unfunded) and develop strategies to close the gap over the next few years. Contributions to the various plans are calculated annually by the State, which then transmits these requirements to the County. These annual funding requirements are set by the State and managers and the Arizona Legislature. The County simply reacts to the State’s annual contribution requirement and funds same.”

While the change in Pima County is only on paper, in September the Arizona Auditor General released a report on the Public Safety Personnel Retirement System’s three defined benefit plans, in which it revealed that its inability to meet future retirement obligations is “deteriorating because of required annual permanent benefit increases and lower-than-expected investment returns.” The Auditor General found that sustainablity could improve but “will require statutory and may require constitutional changes.”

The System manages three different defined benefit retirement plans that provide a guaranteed life-long pension benefit: the Public Safety Personnel Retirement System plan (PSPRS plan), the Corrections Officer Retirement Plan (CORP), and the Elected Officials’ Retirement Plan (EORP). As of June 30, 2014, 282 employers participated in these plans, and there were nearly 55,000 members.

The Auditor General noted that the “System and Legislature have taken actions to improve the plans’ long-term sustainability, but their long-term sustainability remains at risk because some actions did not withstand legal challenges and were ruled unconstitutional.”