On November 26, returning home from his visit to Blue Cross Blue Shield of Arizona, Bert V. found mail from Anthem Blue Cross. A form letter said, “we’reworking on your claim,” the one from last June. The same form letter he received in August for the same claim. On December 3 he received more mail from Anthem. The same form letter – actually two — saying“we’re working on your claim.” Both referring to the August claim. Two identical letters in the same envelope. Was this progress?

Having given them time as Erica at Blue Cross Blue Shield of Arizona had suggested, on December 5 Bert tried reaching Anthony at Anthem, 1-800-688-3828. A recording said his wait time would be “seven minutes and 31 seconds.” Better than“45 minutes and one second.”

It was a bit longer, but finally Chanel came on the phone. She checked and told Bert there was no record, no notes, of the November 26 long conversation with Blue Cross Blue Shield of Arizona, and no way to locate an Anthony in a company their size. Bert asked to speak with a manager. Bert was put on hold again as Chanel checked further, then asking for the claims information he had given so many times before.

Chanel said it looked like a benefits issue and she would have to talk to CoreSource(formerly called Admin in these articles; Bert and your reporter underestimated CoreSource’s complicity in this mess and wanted to not cause them any embarrassment). Bert was put on hold again, and then was in a three-way conversation, adding CoreSource’s Jane. Jane confirmed that Bert and Millie owed nothing, and insisted that they should send the “Consolidated Explanation of Benefits” to the providers showing “Patient Responsibility $0.00.”

Bert responded that the providers had heard so many different stories that something would have to come from them. The promised research from CoreSource Customer Service Rep Tiffany, whom Bert had talked to the week before, had not, according to Jane, been done. He was referred to a supervisor, Cheryl, and left a message asking for a call-back.

By the end of the day no call had been received, so Bert called CoreSource again and talked this time to Christine. Christine acknowledged that there had been a “disconnect” and that checks would be sent to Bert by the following week so the providers could be paid – by him, for the first time ever, and contrary to what CoreSource had told him earlier – that checks were never sent to members. “Is there anything else we can do?” Christine asked at the end of the conversation.

“Apologize,” Bert said, “not you personally but all of you who have dragged this on for months, who have caused providers to think I am a liar and a thief.” Christine agreed that CoreSource would call the providers and explain that the member was not at fault. Bert and Millie’s situation was finally resolved…maybe.

A closer look at CoreSource on the Glass Door website (https://www.glassdoor.ca/Reviews/CoreSource-Reviews-E26367.htmfound that most employees would not recommend working there to friends. One former employee summed up anonymously: “They preach authenticity when in fact the leadership is the exact opposite – more like fake, arrogant and selfish. They pretend to cultivate a positive work environment and live by these great values but in reality they don’t train you, overload you with work and set you up to fail in every aspect.”

Hopefully this wraps up the Bert and Millie saga at last, but it took many frustrating hours over several months, with untruths, misdirection, finger-pointing,ignoring, and failure to do the necessary research by CoreSource, Anthem Blue Cross, and Blue Cross Blue Shield of Arizona. All were happy to “blame the victim” until ADI brought the story to public attention; Bert made sure they all got copies of the ADI articles. Bert’s retiree organization added some heat on the employer’s benefits office. That is not the way problems with the medical industry should have to be solved, and most people won’t suffer the time and frustration it takes, so we took a look at the existing procedures in place:

Present Arizona Dept. of Insurance procedures are unwieldy and designed mainly for denied claims. They also require that the insurer’s appeals procedures be exhausted before initiating a complaint with the state – hard to do when the insurer stonewalls you. See for yourself at https://insurance.az.gov/consumercomplaint.

Complaints filed with the state also become a matter of public record which will inhibit many aggrieved seniors for fear of losing supplemental insurance and being denied new coverage, being labeled as “troublemakers.” Also, many plans are excluded from the state complaint process, including “companies, corporations and non-profits.” In Bert and Millie’s case, Anthem Blue Cross and CoreSource are based in another state and not subject to Arizona regulations.

The Dept. of Economic Security has an Ombudsman whose scope seems to be limited to Arizona DES programs and, in any event, requires agreement from both parties to actually mediate any dispute. See https://des.az.gov/how-do-i/request-assistance-ombudsman.

There is a website called Get Human which claims to mediate disputes with Anthem Blue Cross: https://problems.gethuman.com/Anthem-Blue-Cross-CA. They show success stories, but we have no first-hand knowledge of how well it might work.

The California Dept. of Managed Health Care,which fined Anthem millions of dollars over their failed grievance procedure, was immediately responsive to questions. They told us that, because the contract is with Anthem Blue Cross,out-of-state residents like Bert and Millie can file with the California agency if filing a grievance with Anthem is unproductive. That’s the first step. Those with Medicare Advantage plans, however,must also use the Medicare procedures before turning to the California agency (see ADI, November 26, 2018). California Dept. of Managed Health Care: 1-888-466-2219; https://www.dmhc.ca.gov/FileaComplaint.aspx.

California also has an Office of the Patient Advocate that issues report cards on insurers in the state. Anthem’s PPO is currently rated as “Good,”with three out of five stars. But the last OPA report, for 2014-2015, rates Anthem third highest in the top ten list of insurers who received complaints, with an average of 39 days to get them resolved. https://www.opa.ca.gov/Pages/default.aspx.

You will have to establish an Anthem online account with user name and password to make that complaint. Bert did so and, with your reporter,navigated their site for about an hour. One possible link came up, saying, “We always hope you’re happy with your coverage. But if there’s something you’re not quite happy with please contact us and we’ll do our best to fix the situation.” Anthem Blue Cross of California: 1-800-688-3828; https://www.anthem.com/ca/login/.

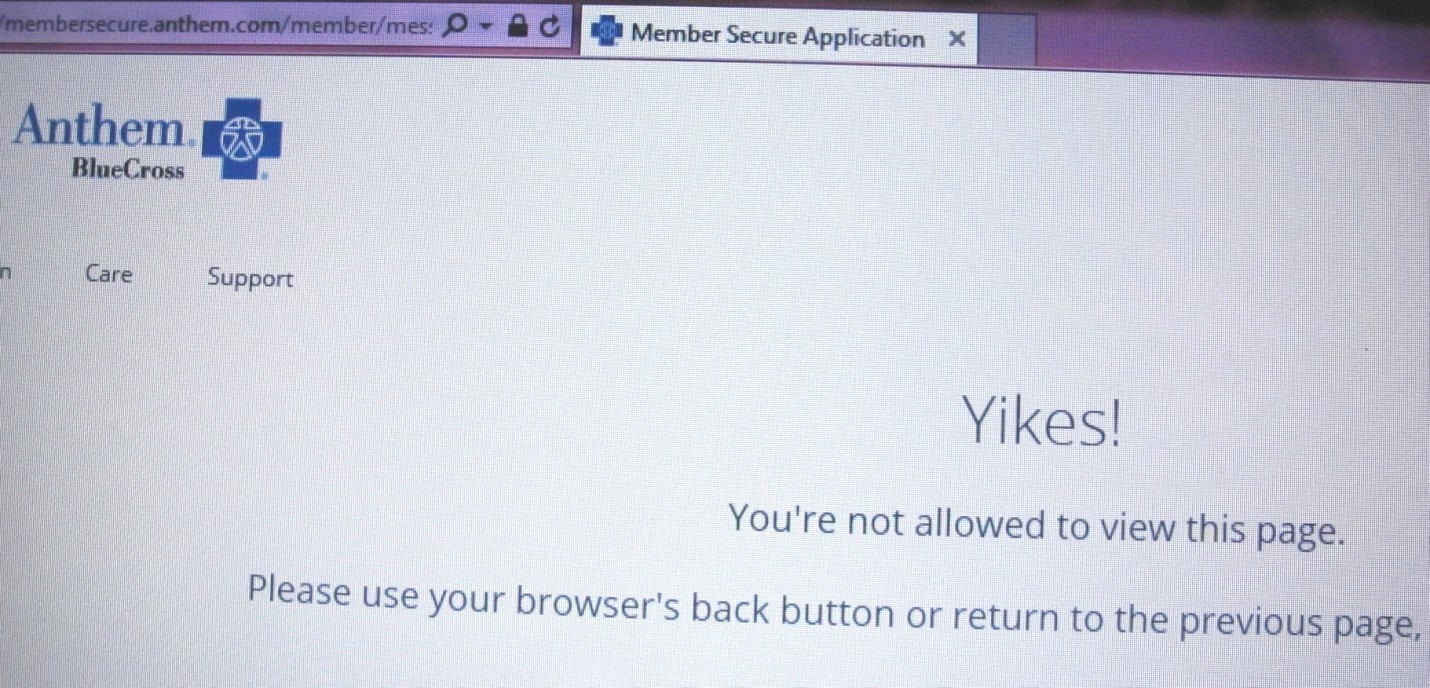

Under that statement was a link, “File an Appeal or Grievance>.” We clicked on it and got: “Yikes! You’re not allowed to view this page.”

We finally found it in the Forms section: https://www11.anthem.com/ca/shared/f5/s2/t0/pw_a119606.pdf. That it took two reasonably competent adults almost an hour to find it is testament to how much Anthem Blue Cross does not welcome complaints and grievances

While the current political climate is for less regulation of businesses, it’s clear that to protect the American people, and especially seniors, more medical industry regulation is needed. Action by the Arizona State Legislature, and by Congress, could require Anthem Blue Cross, CoreSource, and all health care insurers, to:

1. Mandate information sharing where a claim is handled by more than one company. This would cut down on buck-passing and scamming, and enable reasonably prompt responses to patient questions.

2. Have a dedicated and well-publicized local complaint number with real people at the other end and a limited time for an insurer response.

3. Establish a neutral expedited appeals procedure if the patient is unhappy with the response.

4. Establish State Health Care Ombudsman offices where dissatisfied customers can turn for help if the insurer stonewalls or ignores them. Include complaints about out-of-state insurers. Establish an Office of the Patient Advocate, as California has, to monitor and publicize insurer responses to complaints.

5. Insurers to reimburse patients for any unnecessary payments they made because of insurer error or delay; insurer to issue formal apology to members and providers and clear up patient’s credit rating.

5. Include consequences for insurer failure to resolve problems in a timely manner.

It’snot establishing a big bureaucracy or over-regulating; it’s simple protection for millions of working and retired men and women, and/or their employers, who are paying into a broken system without recourse. It’s insisting that the recipients of those billions of hard-earned dollars answer for their actions, or lack of; that they fix the problems they created. It’s replacing greed with accountability. And it is not comprehensive health care reform

Pollsters found health care to be the most important issue to voters in 2016. The medical industry has been successful in holding off comprehensive reform ever since the New Deal, and Obamacare was not nearly that needed reform. The medical industry and Big Pharma wrote most of it.

But real reform is needed, bipartisan and intelligent and comprehensive, reform that will be much more complicated than simplistic calls for “Medicare for all”or “Repeal Obamacare.” Reform that allows real people and not industry lobbyists to set the parameters. That takes time, but also commitment from our nation’s leaders that is sadly lacking in the White House and on both sides of the aisle in Congress. It will take mass and sustained pressure to counter the big bucks of the medical industry and Big Pharma. It’s up to us to remind our elected representatives: Working together we can do it! Maybe…. (Last of a three-part series…maybe….)